Foreign Banks: The U.S. Market is Calling.

There may have never been a better business environment to execute on a global strategic plan that contemplates a U.S. presence, or an elevation of an existing U.S. entity, than exists today. For non-U.S. financial institutions this means finding the best charter to support the product and service offering for a U.S. business.

There are various charter options available depending upon (i) the jurisdiction of the financial services entity, (ii) the type of local license issued, (iii) whether the entity would be deemed a ‘Qualified Foreign Banking Organization’ under U.S. law, and (iv) the strategic plan for conducting business in the U.S.

Jurisdiction. The initial factor to determine available charters is whether the foreign financial institution is subject to Comprehensive Consolidated Supervision (CCS). A foreign bank is considered to be subject to CCS if the Federal Reserve determines that the foreign bank is supervised or regulated in such a manner that its home country supervisor receives sufficient information on the worldwide operations of the foreign bank, including the relationship of the bank to its affiliates, to assess the foreign bank’s overall financial condition and compliance with laws and regulations. While CCS designations are technically ascribed to the entity and not the jurisdiction, should a financial institution submit an application for a charter in which a like licensed entity from the same jurisdiction has already been approved as CCS, the new applicant, barring unusual circumstances, would benefit from that previous determination. Jurisdictions in which financial institutions have been determined to be subject to CCS (or approaching a CCS standard) are limited[1]. Financial institutions from all other jurisdictions are deemed to be non-CCS.

Local License. If the foreign bank operates under a full scope banking license, or equivalent, i.e. is engaged in deposit taking, extending credit, and provides payment facilities, then the U.S. chartering options would include those charters with the broadest powers.

QFBO. A foreign banking organization that is deemed to be a ‘Qualified Foreign Banking Organization’ receives certain exemptions from the application process and are entities that under US law may, among other things: engage in activities of any kind outside the United States; and engage directly in activities in the United States that are incidental to its activities outside the United States. The test to qualify for the exemptions and privileges is that, disregarding its United States banking, more than half of its worldwide business is banking; and more than half of its banking business is outside the United States.

Strategic Plan. Depending upon the Financial Institution’s proposed product and service offerings, charter options may dictate what filings are available. However, once a strategic plan is approved, the Financial Institution is effectively bound to its self-imposed limitations for a three-year period, absent a separate request for relief from the regulators, and any material changes may lead to the need for enhanced internal controls or potentially a different charter. Accordingly, if the long-term proposition is to engage more fully in the business of banking, then the charter affording the broadest product and service permissions should be considered in the application process.

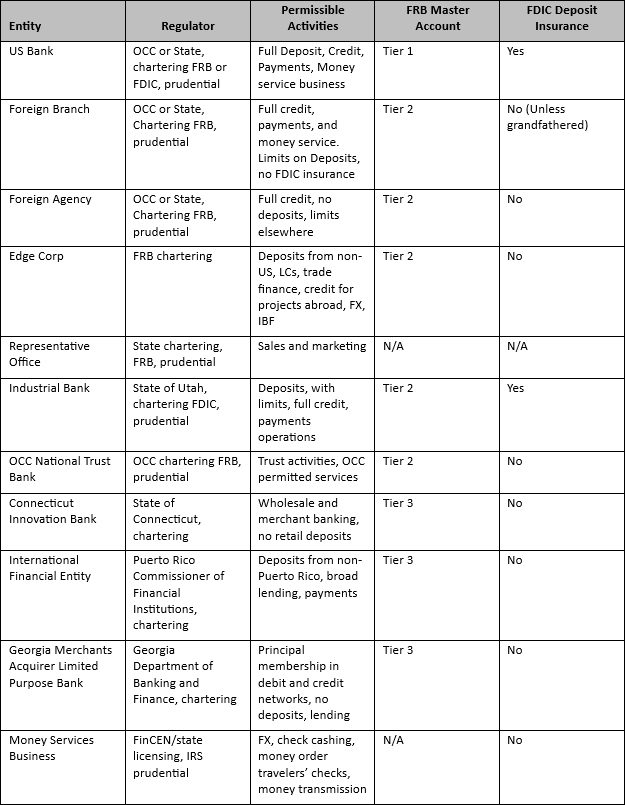

CCS Entities. Several main charter options for CCS designated QFBOs are included below. Applicants for US banks, foreign branches and agencies have structural charter options, a federal charter issued by the Office of the Comptroller of the Currency (OCC), or a state banking department charter issued by the state in which the entity is located. The chartering regulator may be factor in determining which structure to pursue.

- Acquiring an on-going US Bank. Foreign ownership is permitted for OCC chartered, and most state chartered full-service banks. These entities enjoy full deposit powers, with FDIC insurance, full credit facilities offerings, payments operations, including principal membership in credit and debit networks, and full money service business powers, including foreign exchange and money transmission. They are also Tier 1 eligible for Federal Reserve Master Accounts.

- De Novo US Bank. If assuming the liabilities of an on-going bank is a deterrent, then a foreign bank may apply for a de novo US bank charter. As with all de novo applications, in addition to the creation of a strategic plan, the applicant would, among other things, need to manage the logistics of securing a location, hiring management, ensuring funding sources, IT connectivity, development or management of correspondent relations, and file separately for a Master Account.

- Foreign Branch. A foreign bank that meets the factor criteria above may establish a foreign branch. In the case of a federal foreign branch, the entity would be afforded all of the powers of a domestic national bank, with certain deposit limitations and non-eligibility for FDIC insurance. A foreign branch has Tier 2 eligibility for a Federal Reserve Master Account, and because it is not a separate corporate vehicle has capital requirements found in the Capital Equivalency Deposit rules, which as a de novo typically amounts to 10-15% of non-intra company liabilities.

- Foreign Agency. This entity has similar rights and obligations as a foreign branch. However, a foreign agency may not accept deposits or exercise fiduciary powers. A foreign agency primarily makes commercial loans and finances international transactions. Although a federal foreign agency cannot accept deposits, it can maintain credit balances.

- Edge Corporation. Unique, as this is one of the few entities that the Federal Reserve actually charters. While primarily designed for US entities, foreign banks are eligible to establish Edges and currently several foreign banks possess Edge Corporations. Permissible activities of an Edge Corporation include: Deposit taking from foreign individuals/entities; Deposit taking from U.S. residents for purposes of transmission abroad; wire transmissions; Letters of Credit issuance; Finance contracts, projects and activities performed substantially abroad; Trade Finance credit facilities; Credit Participations with U.S. banks; foreign exchange activities; Establishment of International Banking Facilities.

Non-CCS Financial Institutions (as well as CCS designated) have chartering options such as the following:

- Representative Office. These entities are exclusively chartered by the states and technically are not banking entities. These are sales and marketing offices permitted to engage in representational and administrative functions in connection with the banking activities of a foreign bank, including soliciting new business for the foreign bank, conducting research, acting as a liaison between the foreign bank’s head office and customers in the United States, performing preliminary and servicing steps in connection with lending, and performing back-office functions. A representative office may not contract for any deposit or deposit-like liability, lend money, or engage in any other banking activity.

- Industrial Bank. An industrial bank is a state-chartered depository institution[2] that is eligible for FDIC insurance; exempted from the technical definition of a “bank” for the purposes of the Bank Holding Company Act of 1956 (BHCA); and otherwise generally subject to the same banking laws and regulations as other bank charter types. The exemption from the BHCA means corporate owners of an industrial bank do not necessarily have to be bank holding companies. This enables non-financial companies to own and operate an industrial bank. Industrial banks, while subject to the same regulatory and supervisory processes as any other bank, are authorized to make all kinds of consumer and commercial loans and to accept federally insured deposits. Although an industrial bank may not accept demand deposits if the bank has total assets greater than $100 million.

- OCC National Trust Bank. This is a limited purpose entity that may not engage in deposit taking or credit extension. A national trust bank is permitted to engage in any and all activities permitted under state law for a state trust company located in the same state. Moreover, a national trust bank may also engage in activities beyond those authorized under state law for a state trust company provided such activities are permitted for a national bank under other sources of authority, such as custodial services for stablecoins. A national trust bank is subject to the Bank Secrecy Act, anti-money laundering, Office of Foreign Assets Control requirements, and consumer protection.

- Connecticut Innovation Charter. A state chartered limited purpose bank. Innovation Banks may engage in wholesale banking and merchant banking and have all of the powers of an FDIC insured bank, except an Innovation Bank cannot accept retail deposits and is not eligible for FDIC insurance. Under this charter, financial institutions will have direct access to credit and debit networks. Like an Industrial Bank, the charter is available to non-financial companies.

- International Financial Entity. A special purpose vehicle chartered by the Puerto Rico Commission of Financial Institutions. An IFE may engage in specific banking and financial activity in Puerto Rico, but only with non-residents of Puerto Rico. These activities include: accepting deposits from foreign persons; extend, guarantee, or service loans; issue Letters of Credit; and, generally, engage in any activity of a financial nature outside of Puerto Rico which would be allowed to be done, directly or indirectly, by a bank holding company or by a foreign office or subsidiary of a United States bank under applicable United States law.

- Georgia Merchant Acquirer Limited Purpose Bank. A state chartered limited bank permitting entities to obtain principal membership in credit and debit networks but does not permit the general business of banking.

- Money Services Business. These are non-bank financial institutions that engage in one of more of the following activities: foreign currency dealer or exchanger; Check casher; Issuer of traveler’s checks, money orders or stored value; Seller or redeemer of traveler’s checks, money orders or stored value; and Money transmitter. Registration is through the Financial Crimes Enforcement Network (FinCEN) and for money transmitters licenses with every individual state.

The foregoing is not an exhaustive list of available financial institution charters in the U.S. but recognizes the most prevalent ones currently in use. If execution on a strategic plan to enter the U.S. or raise the US profile is under consideration, come speak with Atlantis International who can not only assist in selecting the most appropriate chartering path, but will be a partner with your organization from application development through opening for business.

[1] Mexico, Brazil, Chile, Argentina, UK, Ireland, Netherlands, Belgium, France, Germany, Spain, Italy, Switzerland, Finland, Norway, Israel, Japan, Taiwan, South Korea, China, Canada, Australia.

[2] The overwhelming majority of Industrial Banks are chartered by the Utah Department of Financial Institutions.